Ras Ghamila: Is Egypt about to sell a prime Red Sea area to Saudi Arabia?

Saudi Arabia is close to securing a $15bn deal with the Egyptian government to develop Ras Ghamila, a prime Red Sea tourist destination, as part of the government’s efforts to alleviate the economic crisis, according to an Egyptian government source.

The source, who spoke with Middle East Eye on condition of anonymity, said the Egyptian prime minister will announce the details of the deal soon.

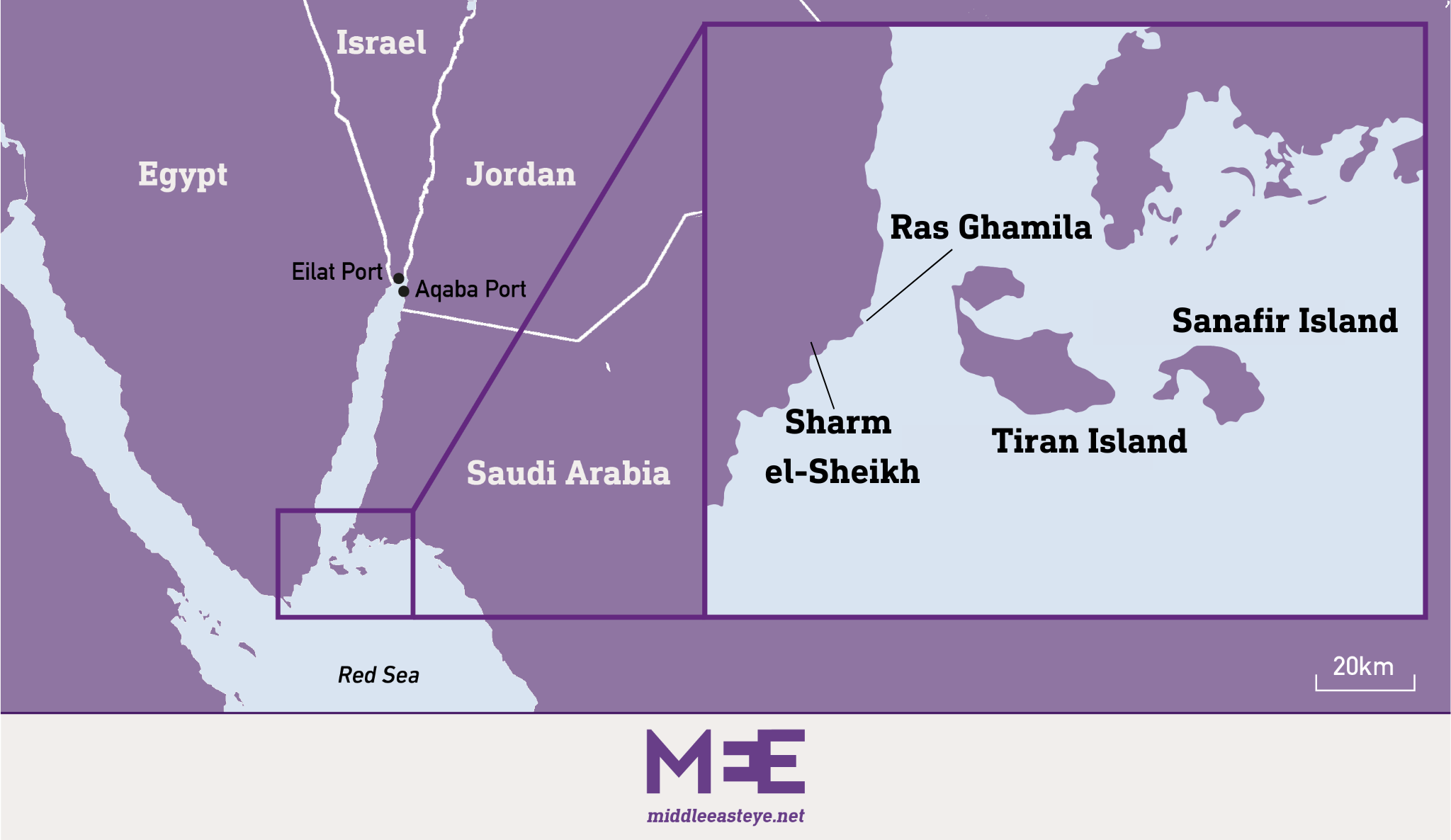

Ras Ghamila, a popular diving destination, is located around 11.5km from Sharm el-Sheikh international airport in South Sinai governorate.

It is also opposite the Tiran Island, one of two Red Sea Islands that Egypt ceded to Saudi Arabia in 2016 after a deal that drew significant popular backlash.

Stay informed with MEE's newsletters

Sign up to get the latest alerts, insights and analysis, starting with Turkey Unpacked

The Saudi Okaz newspaper on Sunday reported that the Egyptian government is considering “huge Saudi investments” as part of a bidding process underway to develop Ras Ghamila.

Meanwhile, the independent Egyptian news website Manassa also reported that the government has received a Saudi bid worth $15bn to develop the area.

The Daily News Egypt, another independent outlet, reported that the government has received bids from the Saudi Public Investment Fund and the Qatar Investment Authority, and that the winner will be announced within two months.

Calling for the bid was planned to take place in 2021 but was delayed due to the Covid-19 pandemic, the source told MEE. It is part of the state’s efforts to promote integrated urban development by the year 2052, he added.

Mahmoud Esmat, Egypt’s minister of public business sector, announced plans earlier in February to offer the area for investments.

On Monday, Esmat told the government-linked website Cairo24 that his ministry has commissioned an “international consulting office” to prepare for offering Ras Ghamila land for investment. He said no specific investors have been selected yet.

He said the area is around 860,000 sqm and has a high strategic value.

Importance for Saudi Arabia

According to the Egyptian government source, the Saudi investors are keen to secure this deal due to Ras Ghamila’s proximity to Tiran and Sanafir Islands, and its potential to boost tourism between Sharm el-Sheikh and Neom in Saudi Arabia.

The source said the Saudi offer includes the construction of an area of 400,000 sqm and “there will be due care given not to alter the region's nature or environment character.”

It will be an investment partnership similar to the Ras el-Hekma deal that Egypt signed with the the United Arab Emirates (UAE) last week, he said.

“It will include big brands of five star hotels, shopping malls, diving centres, entertainment destinations, food courts, rental apartments, business centres, and a conference hall for events and concerts,” the source said. “It will be expected to draw 30 million tourists by 2027,” he added.

The Saudi offer does not include pulling its deposits from the Central Bank of Egypt, unlike the UAE deal that included converting $11bn deposits to a grant, the source pointed out.

On Friday, Egypt signed a $35bn deal with the UAE to develop the area of Ras el-Hekma on its northwestern coast. Prime Minister Mostafa Madbouly said that Egypt will receive an advance amount of $15bn in the coming week, and another $20bn within two months.

He hailed the Ras el-Hekma deal as the largest foreign direct investment in an urban development project in the country's modern history.

While government opponents have criticised the lack of transparency in reaching the deal, a number of economists and business tycoons in Egypt welcomed it for its potential to stabilise the currency, as black market rates of the Egyptian pound are nearly double the official rate of 31 to the US dollar due to foreign currency shortage. On Monday, the black market rate fell to 52, down from 62 prior to the deal.

Madbouly said that Cairo is now "very, very few steps away" from reaching an agreement with the International Monetary Fund. The deal is projected to exceed $10bn and is expected to be followed by currency devaluation to match black market rates, one of the conditions of the international lender.

The Egyptian government is heavily indebted, with foreign debt quadrupling over the past 10 years, reaching $164bn. Debt servicing is currently consuming most of the state's annual expenditures.

Egypt's total foreign currency reserves stood at $35.25bn in January.

Middle East Eye delivers independent and unrivalled coverage and analysis of the Middle East, North Africa and beyond. To learn more about republishing this content and the associated fees, please fill out this form. More about MEE can be found here.